On June 25, 2019, Illinois Governor JB Pritzker signed House Bill 1438. The legislation made Illinois the 11th state to legalize recreational cannabis and provided for the eventual legal sales of adult-use cannabis products through licensed retail outlets.

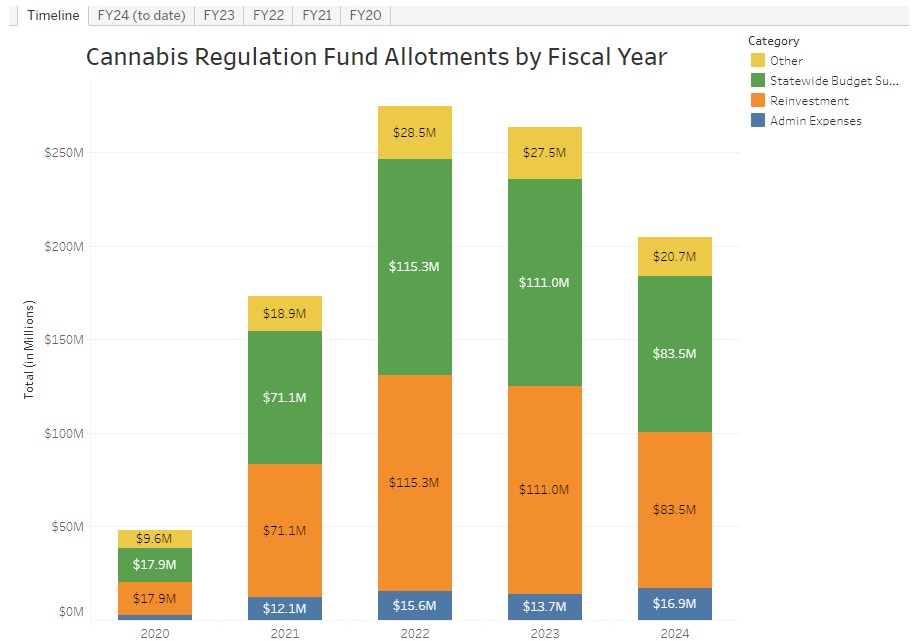

On January 1, 2020, the first legal adult-use cannabis purchase was made in Illinois, and since that time the state’s legal cannabis industry has made a considerable amount of sales and generated a significant amount of tax revenue. Below is a summary graph of cannabis tax regulation fund allotments by year via the Illinois Cannabis Regulation Oversight Office:

Below is a description of each fund area via Illinois Policy:

- Administrative expenses: This refers to costs for agencies tasked by state cannabis laws with overseeing marijuana sales, such as the Illinois State Police and the Department of Agriculture.

- Reinvestment: Restore Reinvest Renew (R3) grant funds are designated for Illinois communities that have been affected by “violence, excessive incarceration, and economic disinvestment.”

- Statewide budget support: The Budget Stabilization Fund, known as the “rainy day” fund, and general revenue funds get the same amount as community reinvestment receives each year.

Illinois taxes adult-use cannabis products based on their THC content, with higher THC percentages corresponding to higher taxes, up to 25%. Cannabis products can also be subject to state (6.25%), county (1.75%), city (1.25%) and special (1%) taxes. In March 2024 alone, the legal Illinois adult-use cannabis industry topped $148 million in sales.

Total legal cannabis sales in the United States are expected to reach $31.4 billion in 2024 according to a recent analysis by Whitney Economics. Additionally, leading cannabis jobs platform Vangst, in conjunction with Whitney Economics, estimates that the legal cannabis industry now supports 440,445 full time-equivalent cannabis jobs in the United States.

Whitney Economics also projects the following legal cannabis sales figures in the United States for the coming years:

- 2024: $31.4 billion (9.1% growth from 2023)

- 2025: $35.2 billion (12.1% growth from 2024)

- 2030: $67.2 billion

- 2035: $87.0 billion

The emerging legal cannabis industry in the United States is projected to add roughly $112 billion to the nation’s economy in 2024 according to a newly released analysis by MJBiz Daily. The projection is part of the company’s 2024 MJBiz Factbook.

“The total U.S. economic impact generated by regulated marijuana sales could top $112.4 billion in 2024, about 12% more than last year,” MJBiz stated in its initial reporting.